In November of last year, Janet Fernandez, a California homeowner, received a notice from her mortgage company stating her mortgage escrow account that held funds to pay her homeowners insurance and property taxes was short by $4,814 because her insurance premiums had increased due to the wildfires in her area.

The shortage meant that Fernandez’s mortgage payment would increase by over $1100 a month unless she paid the entire shortfall upfront. She did with her remaining savings. However six months later, her escrow was short again by $2,216, which she could not pay with her savings. She figured she could continue to pay her mortgage payments at the old amount and catch up later. 6 months later in May she received a notice from her mortgage company that her payments were delinquent, her mortgage in default.

“Living in California, owning a home, having to keep up with the steady increase of bills and costs, is becoming unmanageable for many of us,” Fernandez said. “I can’t afford another sudden shock shortage.”

This story of a sudden escrow shock is not uncommon now for homeowners across the country. J.D. Power reports that 56% of homeowners polled stated that their escrow payment increased in the last year, up from 51% in 2021 and 49% in 2020.

The shortages reflect the increases in homeowners insurance policies, due to the natural disasters occurring more often all throughout the country. From Wildfires in California, Oregon, Montana and Washington. To the increase in hurricanes in the south east, and ever present tornadoes in the midstates. Not to mention inflation and higher property tax assessments after home prices shot up during the pandemic years. The escrow shortages are causing financial havoc for many homeowners who have already had their budgets impacted by rising costs and inflation in the last year.

“Escrow changes are impacted by taxes and insurance, so material increases that weren’t anticipated will definitely lead to shortages,” stated Craig Martin, executive managing director and global head of wealth and lending intelligence at J.D. Power.

What is a Mortgage escrow?

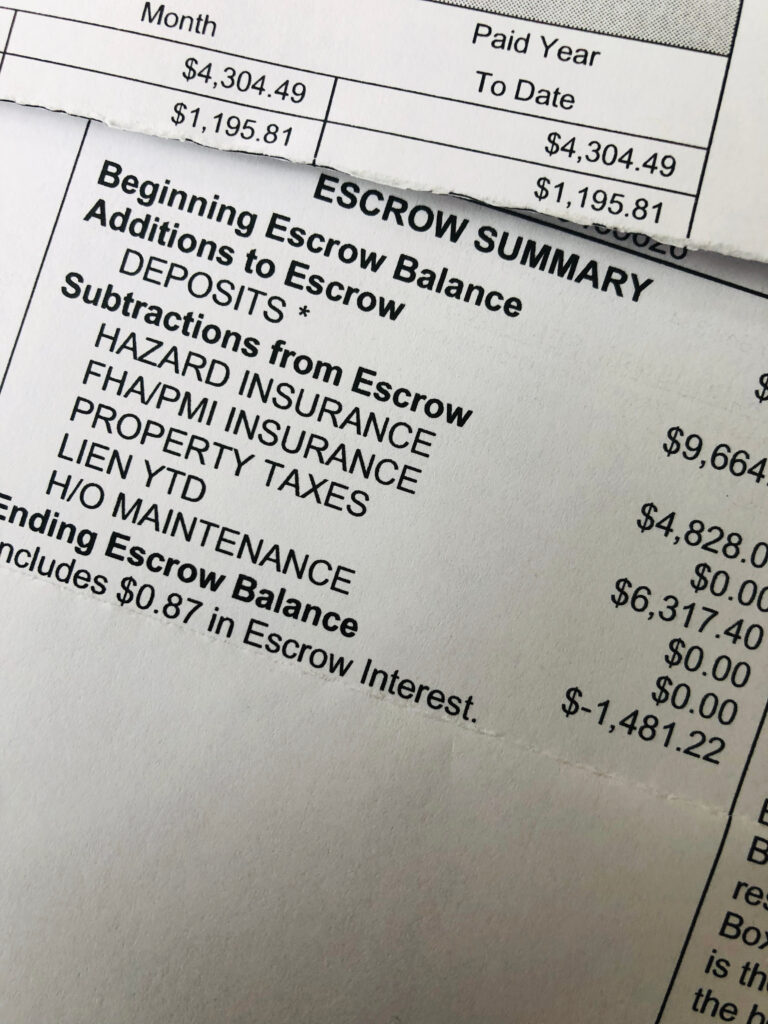

After a homebuyer purchases a home with a mortgage, the lender establishes a dedicated escrow account to pay for property taxes and insurance. A portion of the monthly mortgage payment is held in this escrow account until tax and insurance payments are due, which typically come around once or twice a year.

“The escrow account must be enough to cover homeowners insurance policies and property taxes for at least two months, so there can be an advance in case homeowners insurance premiums suddenly increase or there can be an increase to set up for upcoming years,” says Bruce Terry, advocate at Homeowner Protection Alliance.

Mortgage lenders usually calculate the escrow amounts on what was paid the year before for county property taxes and insurance. However those figures could be off, prompting the lender to raise the monthly payment or require a one time lump sum to meet its minimum escrow balance.

Mortgage companies almost always require a set escrow account because they never want to have a property on their books that is behind on property taxes or insurance. Reasons are clear and profound. The county tax collector holds supreme control over foreclosure rights of the property. Meaning if a homeowner falls behind on property taxes, even if they are current on the mortgage, the local tax authorities could foreclose on the property. No matter the standing of the homeowner with their mortgage companies. The mortgage companies also do not want to have a property on their books that is not property insured against a fire, or flood, or other natural disaster. They never want to be liable. They prefer the liability to always be on the homeowner or their insurance carrier.

The homeowner insurance Element:

In 2022, homeowners insurance premiums increased by over 10% in the first quarter, according to an S&P Global Market Intelligence analysis. There are two big reasons for this increase: inflation and the increasing prevalence of natural disasters stemming from climate change.

On the inflation side, costs for construction materials and labor have been consistently rising and were made further expensive during the pandemic. Caused by supply chain issues and nation-wide health precautions.

As a result, the average construction cost of a typical single-family home last year was $153 per square foot, according to a policy survey from the National Association of Home Builders. That marked the highest level in the history of this series and was up 43% from $114 in 2019.

That affects the dwelling coverage of homeowners insurance, or the cost to repair or rebuild the home from scratch. That replacement cost value usually differs from the home’s fair market value, according to insurer Progressive.

“The reality is inflation has increased the cost of every aspect involved in an homeowners insurance claim [and] it is costing more and taking longer to rebuild homes after a covered loss,” Mark Sektnan, vice president for state government relations of the American Property Casualty Insurance Association(APCIA), told the Insurance Journal.

The problem is only getting worse since natural disasters are occurring with more annual frequency. and at greater intensity due to climate change. A CoreLogic study estimates that annual losses nationwide could increase to $23.5 billion per year by 2050 from now.

Faced with a record number of premium payouts, and increased costs, insurers are passing this onto homeowners in the form of higher premiums.

In some cases, insurers are outright leaving particular high risk markets. For instance, State Farm recently announced that it would no longer issue new policies in California due to wildfire risk and last year AIG announced its intention to exit the California homeowners market.

Florida homeowners are also feeling the financial crunch of premium increases along with trying to find coverage as insurers leave the market. Recently, Florida’s state-run insurer of last resort, Citizens, announced that it was dropping customers.

“Coastal areas have had large shifts in insurance companies willing to maintain that risk in their portfolio and several carriers are pulling out of coastal areas up and down the east coast, like South Carolina when UPC discontinued coverage,” Shawn stated.

When fewer insurers exist, the market “moves more towards a geographical monopoly,” Shawn said, with little competition to help keep a lid on premium increases.

The property tax Element:

“Property taxes are another factor and it’s already happening in some areas — like Idaho,” Shawn said. “States that don’t have property taxes locked in can see an increase in property taxes as a result of people coming to their state from other states driving tax assessments.”

The pandemic housing boom and the ability to work remotely spurred domestic migration to more rural less expensive areas, increasing home prices in those local markets for the local population who still rely on local work and income levels.

“Property taxes are connected to property values, so some homeowners won’t feel it right now because states evaluate property taxes at different times,” Janelle Fritts, former policy analyst at the Tax Foundation, told Yahoo Finance.

But for some homeowners, the increase is already happening.

Last year, $339.8 billion in property taxes were levied on single-family homes in 2022, an increase of 3.6% from $328 billion in 2021, according to ATTOM, which curates land, property, and real estate data. That was more than double the 1.6% increase in 2021.

That translates to $3,901 on the average single-family home, a 3% increase after rising 1.8% the previous year.

Even if your state has low property taxes, your location within that state may have higher property taxes. State tax collections make up 31.1% of property taxes, while local tax collections contribute 71.7%, according to the Tax Foundation.

For example, homeowners in San Antonio, Texas average $3,941 in property taxes, but homeowners in Austin have the fifth-largest property tax in the U.S. paying a median of $6,397, according to a study by LendingTree.

How to Reduce Escrow costs:

Rising inflation is directly impacting Americans Family’s budgets. Forcing many to make financial sacrifices, with 57% dipping into savings to manage rising living costs, according to a Nationwide survey.

“Most states have property tax limitations through a rate limit or levy limit [and] these caps help protect from rising inflation,” Fritts said.

Some states and municipalities have property tax relief programs if you have a disability, limited income, are a veteran or a senior citizen. Such programs are referred to as property tax exemptions.

Although homeowners can appeal a property tax assessment, hiring a lawyer many times is the most efficient and powerful tool.

When it comes to lowering homeowners insurance premiums, homebuyers should be proactive before purchasing their home, especially if they are in a disaster prone area.

Questions to consider:

- Is your home located in a fire zone, and to what extent?

- How far away is the closest fire zone and does your home’s proximity to it affect hazard insurance premiums?

- Is your home in a flood area and how close is the nearest flood zone? If it is close, have a land surveyor ensure that the house is outside of a floodplain.

If you’re already in your home or shopping for a new insurer, there are options.

Dwelling coverage is based on the cost to rebuild your home, not the land so don’t include the value of the land in replacement building costs to lower your premium, according to the Insurance Information Institute.

Other options to lower your homeowners insurance premium include raising your deductible, using a replacement cost estimator, and reducing the amount of your personal property coverage because the average homeowner doesn’t have personal property valued at $250,000, Sharon said.

If you raise your deductible and live in a disaster prone zone, that may have consequences as well.

“If a wildfire burns my home, I may have to sell my home because my deductible would require me to pay $50,000 out-of-pocket before insurance covers it,” Fernandez said.

Bruce Terry is a mortgage Advocate at Homeowner Protection Alliance.